Authored by our tax lawyers the book provides a practical and legal analysis of current issues faced by Malaysian taxpayers ranging from corporate taxpayers to company directors and local manufacturers. Place of exercise of employment.

Tax Haven Offshore Bank Developing Country

Treatment of bad debts.

. Up to RM3000 for kindergarten and daycare fees. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system. Sales tax fully waived for new passenger vehicles.

Xxiv Figure I5 External Trade for Malaysia 20002018 RM Million. Policy Framework Tax Accounting and Regulatory. Reduce its current tax liability relative to its pretax accounting income.

Currently individuals who are tax residents with a chargeable income. Creation of a permanent establishment PE for an enterprise or entity. These unintended and unplanned presence and absence have given rise to tax issues as follows.

Xx Figure I2 Household Income by States. Areas of coverage include. Tax residence in Malaysia.

These unintended and unplanned presence and absence have given rise to tax issues as follows. What is the change. Under this provision a company director during the period in which that tax is liable to be paid by the company can be made personally liable for such taxes provided that he holds directly or indirectly more than 20 of the companys shares.

Place of exercise of control and management. Under the IGA reporting Malaysia-based financial institutions will provide the Malaysian Inland Revenue Board with the required. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

Toys for Boys. Xxi Figure I3 Household Income by Ethnics and Income Class. Expat employees who work in Malaysia for more than 60 days but less than 182 days are classed as non-residents - and must pay income tax at a flat rate of 30.

94 Issues of Double Taxation and Tax Treaties Where income from e-commerce by a resident person is subject to tax both in Malaysia and the foreign country provision for relief is available in the relevant Double Taxation Agreement DTA entered into by the. This is in line with its focus on tackling the issue of missing revenue from the shadow economy. 2015 Tax Issues Current Malaysia Essay In.

Effective from January 1 2022 Malaysian residents will be taxed on their foreign-sourced income that is received in Malaysia. RM9000 for individuals. John RuberryShutterstock Aug 8 2022 1201 AM.

Xxiv Figure I6 Indicators for Innovation 20082017. During colonial rule the British introduced taxation to the Federation of Malaya as it was then known with the Income Tax Ordinance 1947. Malaysia and the United States had on 30 June 2014 reached an agreement in substance on a Model 1 IGA to implement the Foreign Account Tax Compliance Act FATCA.

The IGA was formally signed on 21 July 2021. Xxii Figure I4 Gini Coefficient for Malaysia 19802015. Investment Banking for Family Business.

Whilst income derived from the branch in Malaysia is liable to tax in Malaysia. 1341 Sales Tax 13411 Effective date and scope of taxation Sales tax is a single-stage tax imposed on taxable goods manufactured locally by a registered manufacturer and on. Of the Income Tax Act 1967 ITA.

In our book Spotlight on Current Malaysian Tax Issues we. Place of exercise of employment. Review of income tax rate for individuals.

On 6 November 2020 Malaysias minister of finance announced the 2021 national budget. Family Business Reorganisation. Tax evasion particularly in developing countries is a debatable issue.

The current issue and full text archive of this journal is available at. 5 hours agoThe Tyranny of the Current Thing. The ministry focusses on issues of national and international tax policy and is.

Taxability of awards of compensation. Keywords malaysia taxation corporation corporate taxpayers tax complexity. Expat employees who work in Malaysia for more than 182 days are classed as residents - they must pay income tax at the progressive rates set by the Malaysian government.

Evasion is a disease and needs to be minimized so that the black economy or. Malaysian tax enforcement in 2020 - Updates. Following the recently concluded Special Voluntary Disclosure Program SVDP in September 2019 the IRB will increase its staff allocation for its enforcement activities from 60 to 80 in 2020.

Through this measure the government hopes to comply with the scope of the OECD Forum on Harmful Tax Practices and could help remove Malaysia from the European Unions grey list of tax havens. Below are the relevant issues from the individual tax as well as an employers and employees perspectives. Action Figures.

By States in Malaysia for January Until March 2019. Current Thingism erodes our ability to think critically about important issues. The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968.

100 exemption on import and excise duties sales tax and road tax for electric vehicles. Malaysian tax enforcement in 2020 - Updates.

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

29 Crucial Pros Cons Of Taxes E C

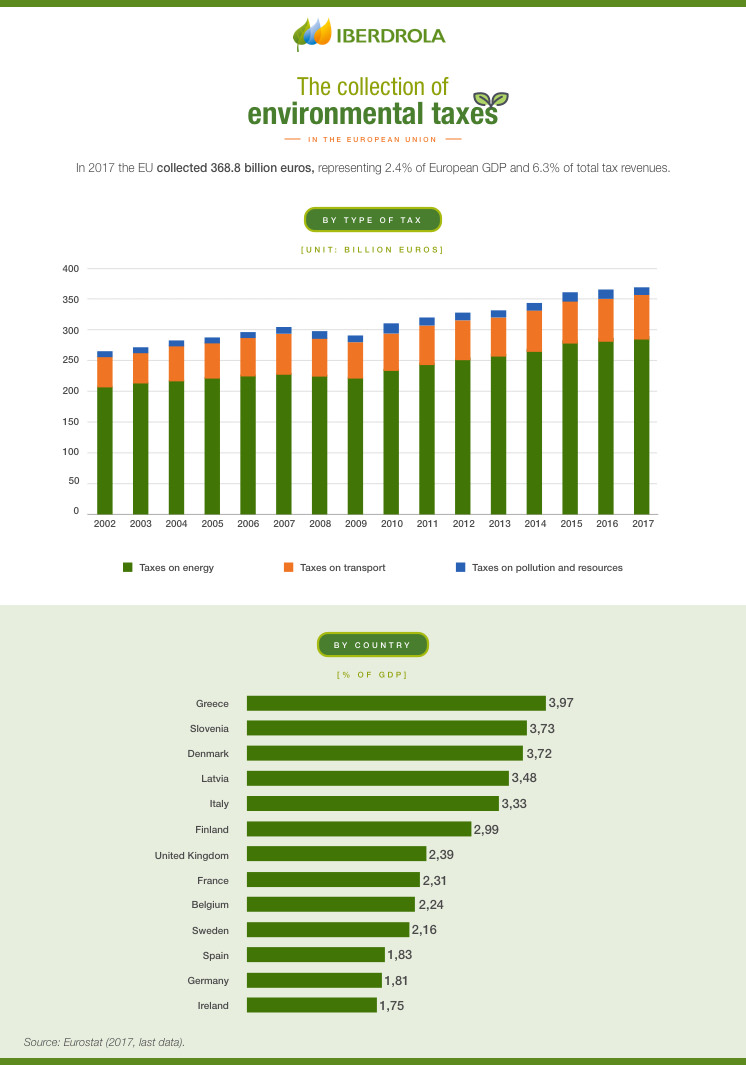

What Are The Green And Environmental Taxes Iberdrola

Doing Business In The United States Federal Tax Issues Pwc

What Are Payroll Taxes And Who Pays Them Tax Foundation

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Why It Matters In Paying Taxes Doing Business World Bank Group

Individual And Corporate Tax Reform

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Annuity Taxation How Various Annuities Are Taxed

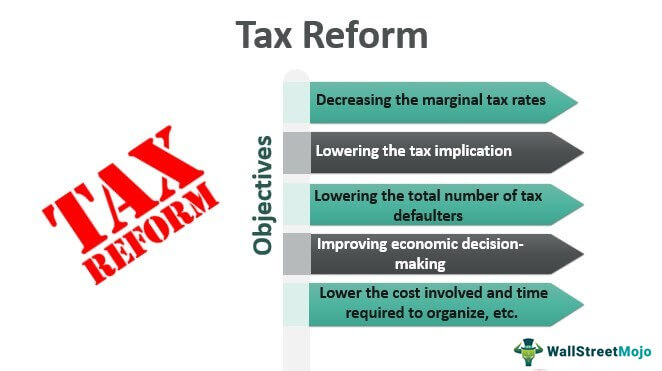

Tax Reform Meaning Types Objectives Example

Annuity Taxation How Various Annuities Are Taxed

Effects Of Income Tax Changes On Economic Growth

Chicago Property Taxes Hit Poorest Disproportionately Tax Debt Tax Attorney Tax Accountant

Why It Matters In Paying Taxes Doing Business World Bank Group

Individual Income Tax In Malaysia For Expatriates